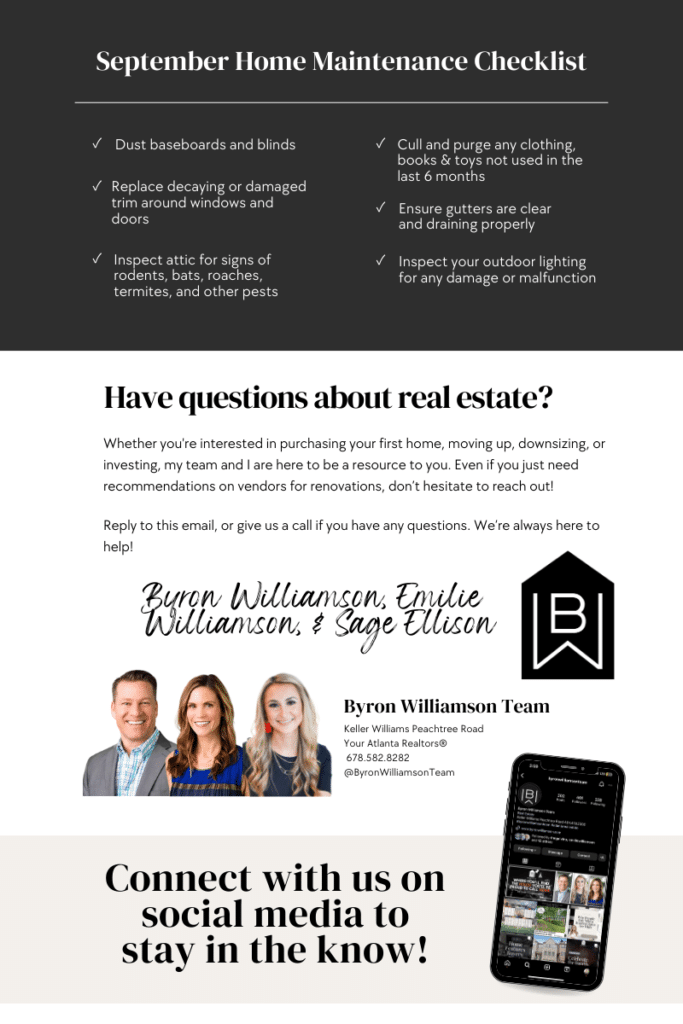

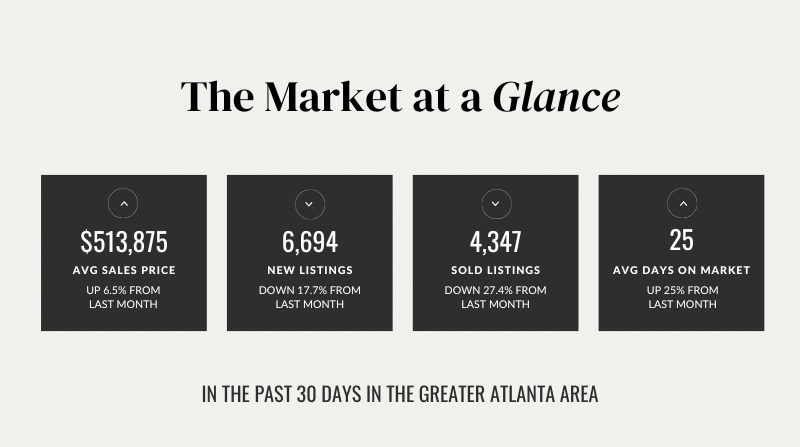

Welcome September – The first month of the fall season! This month we’re celebrating back-to-school routines, the kick off of football and the beginnings of cooler weather.

Keep on reading for all the September updates like what’s going on in Atlanta and the real estate market this month. As always, if there’s anything we can help with, send us a message,

We’re always happy to help & we’re here to be a resource!

What You Need to Know About Seller Concessions

42.9% of home sales in Q1 2023 involved sellers offering to help with closing costs – significantly up from 25.5% the previous year.

That means if you’re planning to sell (or buy) anytime soon, the topic of seller concessions is likely to come up.

Recently, we’ve been able to negotiate to get our buyer a brand new roof, a ‘lease’ payment for a 30 day temporary occupancy of $3,000, many smaller items fixed from the inspection& $10,000 in seller paid closing costs.

For another buyer, we were able to get the sellers to accept our FHA contract in a multiple offer situation. We could do either one, but FHA gave our buyers a significantly lower interest rate, lowering their monthly payment a couple hundred bucks.

Are you interested in results like this? Don’t hesitate to reach out today! We are here to fight for our clients and get them the best result possible!

Wondering how much you should actually spend on a home?

Let’s dive into understanding “debt” a little better — the good kind, that is. We often hear about the 28/36 rule when deciding how much to spend on a home. But what does it mean?

Housing Expense Ratio: This rule suggests that your monthly housing expenses (mortgage, property taxes, homeowner’s insurance) should not exceed 28% of your gross monthly income.

Debt-to-Income Ratio: This part of the rule suggests your TOTAL debt payments, including housing expenses, credit card debt, car loans, student loans, and other obligations, should not go beyond 36% of your gross monthly income.

Sounds straightforward, right? But remember, these percentages are just general guidelines. Some may be comfortable allocating a larger chunk of their income towards housing, while others might prefer less. We like to back into the desired home budget for our buyers by starting with a monthly payment that is comfortable for you, add in estimated taxes, HOA, insurance, etc. and that brings us to the ideal price range for you specifically.

It’s essential to consider factors like your savings goals, lifestyle, and other financial responsibilities when deciding what an appropriate amount to spend on a home is for you!

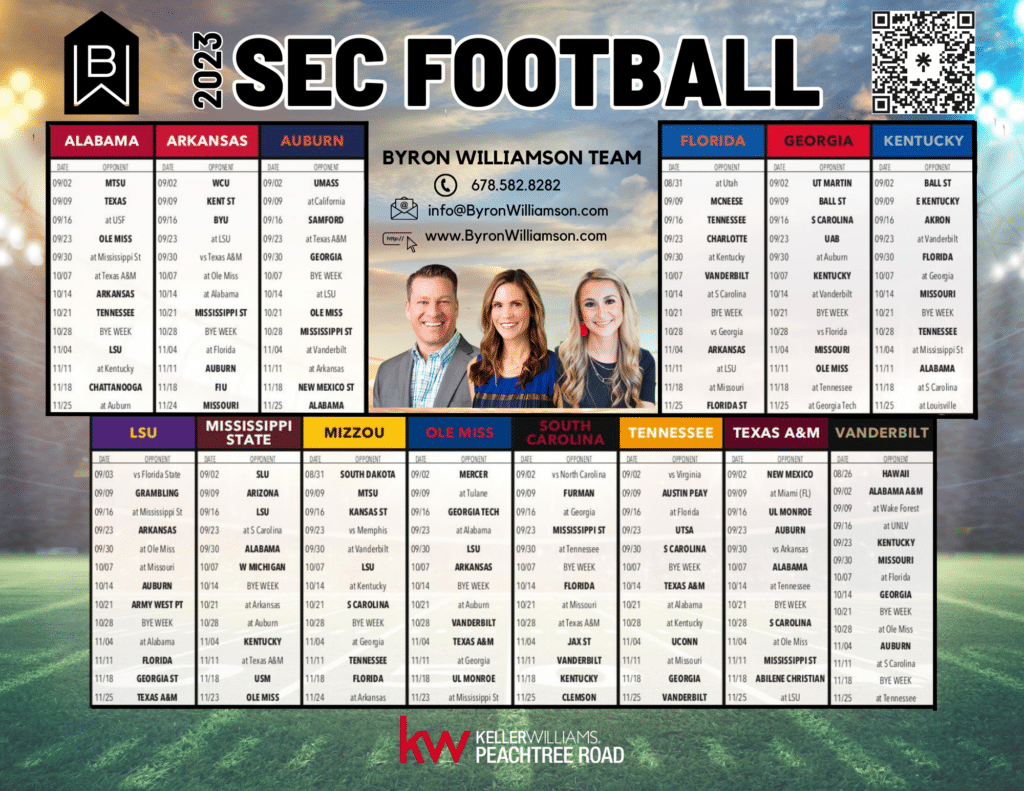

The Real Reason We Love Fall – FOOTBALL

Never miss a game with our SEC Football Schedule

Exciting news for all football fans! College football is back, and we can’t contain our excitement! Join us as we cheer on our favorite teams and witness the epic battles this year! I know we’re most excited for the Deep South’s Oldest Rivalry – Auburn v. UGA as we are a real estate team divided! Don’t miss out on the action, and while you’re at it, why not score a touchdown in the real estate game too?