HEY THERE!

Lucky you! Your March newsletter has arrived just in time to kick off the new month. We’ll cover everything from St. Patricks Day celebrations to saying bye bye to winter and hello to more outdoor time- plus sprucing up our homes for the new season.

Get comfy and stay glued for the can’t miss info in our community this month!

As always, if there’s anything we can assist with, send us a message, we’re always here to be a resource.

Hosting Easter Brunch?

3 TIPS TO KEEP IT STRESS-FREE AND LOW-KEY

Keep it stress-free and low-key with this foolproof, 3-step plan for a memorable gathering.

Brunch Board Magic: Start the morning with a no-fuss, wide-appeal self-serve brunch board. Early birds or late risers can take their pick from a spread of bagels, lox, fresh fruits, hard-boiled eggs, and a variety of jams.

Signature Sips: Elevate your beverage game with a Grapefruit Mimosa that brings citrusy uniqueness to your gathering. For those opting for a non-alcoholic option, have a fruit-forward mocktail ready. Try a virgin pineapple mimosa of pineapple juice & lemon-lime soda.

Make Ahead Maven: Prep an overnight French toast casserole or a croissant egg bake. Make it, forget it, and pop it in the oven the morning of

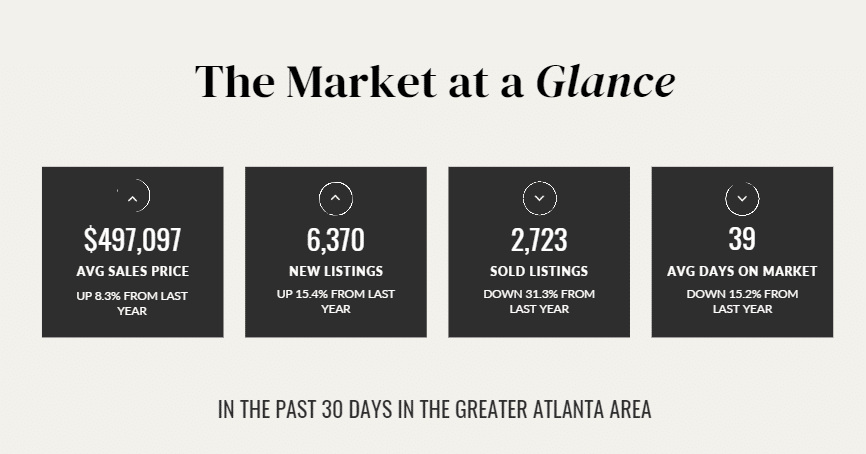

Atlanta homes sell for 8.3% more in February 2024, despite a 31.3% drop in sales.

In other words…

The housing market in Atlanta is becoming increasingly competitive as prices have risen by 8.3% and won’t be going down anytime soon, making it more difficult for buyers to find an affordable home. For sellers, the market conditions are favorable with prices rising, but unless it’s turnkey, homes are sitting on the market a bit longer, the demand is still there, but buyers are being pickier about homes than they have been in the past 3 years.

That’s a write off!

Tax deductible home improvements

ome Office Deduction: To claim a deduction, you must have a dedicated and exclusive workspace. Using your dining table for double duty won’t qualify.

Rental Properties: When renovating rental properties, you can’t deduct the renovation costs. But, expenses like mortgage interest, property tax, operating costs, depreciation, and repairs are eligible deductions to keep your property running smoothly.

Residential Medical Upgrades: Expenses related to improving medical accessibility are deductible. This includes constructing entrance or exit ramps, widening doorways, installing railings or support bars, and making bathroom modifications.

Energy-Efficient Improvements: Consider energy-efficient improvements such as installing solar panels, solar water heaters, small wind energy turbines, geothermal heat pumps, fuel cells, and biomass fuel stoves for potential tax benefits.

Home Sellers Deduction: If you make improvements to your home before selling it, they can increase your home’s basis (purchase price + improvements), reducing capital gains and, in turn, lowering the taxes you’ll owe.

Homestead Exemption: If your home is your primary residence, you can get a property tax reduction.

Always consult with a licensed tax professional this is not official tax advice

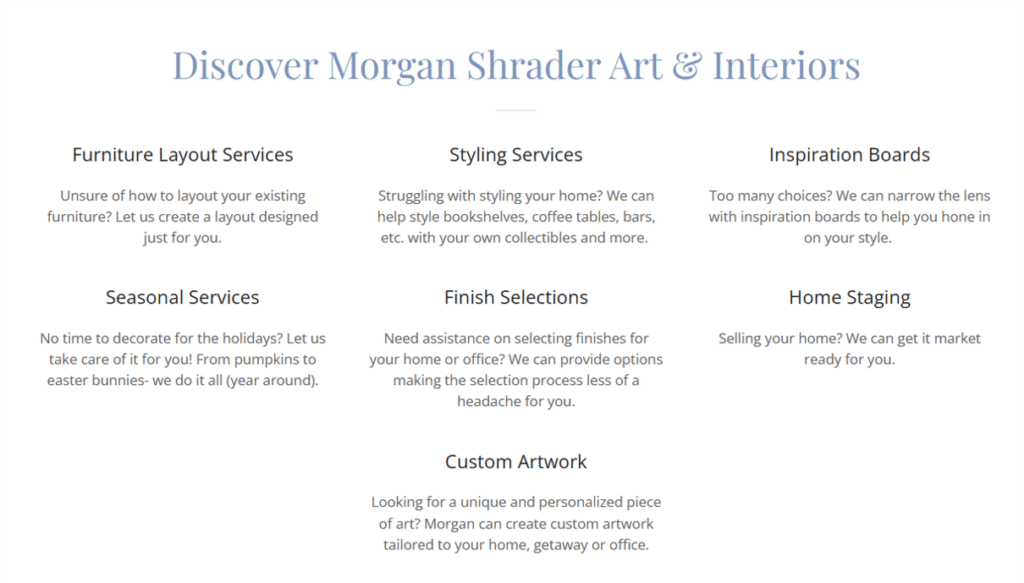

We’re excited to introduce our partnership with Morgan Shrader, owner of Morgan Shrader Art & Interiors. She attended college in Atlanta and received a bachelor’s degree in fine arts in 2009. She quickly landed a role with a well-known and respected commercial interior design firm. She specialized in office space planning and design and loved her time there, and soon after started a family. She has focused on her family for the past several years, but she never lost the desire to design and create! She freelanced residential and commercial projects, commissioned art pieces and found a creative outlet in a boutique she created that traveled to various art shows around the Atlanta area. These experiences and projects have helped her grow as a designer. She is excited to get to know our clients and help you navigate to a beautiful, finished product!