HEY THERE!

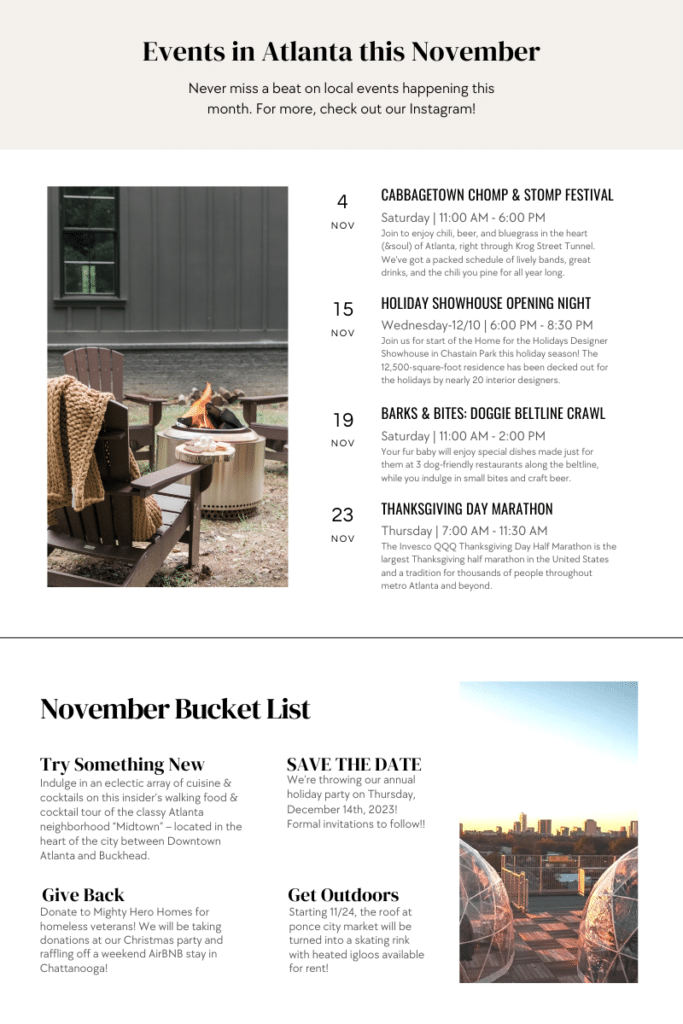

Welcome November – This month we’re celebrating the magic of the holidays, cooler temperatures, and feelings of gratitude as we gather with loved ones and reflect on 2023!

Keep reading for all the November updates like events in Atlanta and the real estate market this month.

As always, if there’s anything we can assist with, send us a message or give us a call, we’re always here to be a resource

What most home buyers actually want?

We’ve helped hundreds, maybe thousands, of buyers find a home. Despite their differences, they all share ONE desire…

NO SURPRISES.

So if you’re thinking of selling in the next few months, here’s your gentle nudge:

✓ Evaluate major home systems – HVAC, plumbing, electrical, and roof.

✓ Fix leaky faucets.

✓ Tighten loose cabinet pulls or door knobs.

✓ Paint dingy walls, doors, and ceilings.

✓ Freshen up the yard by trimming trees and shrubs and laying mulch.

✓ Deep clean carpets.

✓ Declutter, declutter, declutter.

If you’re serious about prepping your home for buyers AND getting top dollar, reply to this email, and we can go over our typical Home Prep Checklist for Sellers

Want a lower mortgage? Try this

Mortgage rates hit their highest point in over two decades this year. Even though interest rates are higher than we would like, you can still go after your homeownership dreams and save on a mortgage.

Consider an adjustable-rate mortgage (ARM). An ARM is a great option for a monthly payment that’s lower than the payments available with fixed-rate loans or for buyers convinced rates will drop after the introductory period ends.

Some experts are predicting that in a year from now, 30-year rates will be around 5.25% and 15-year rates around 4.875%.

Pay for points to buy down the rate. If you have extra funds at the time of purchase, you can pay for mortgage points. This means, you pay a percentage of the loan upfront in exchange for a lower interest rate — and a slightly lower monthly payment.

Work on your credit score. If time is on your side, improve your credit by paying bills on time, lowering your credit utilization (using under 30% of your credit line), and addressing credit report errors. A higher credit score will reduce your mortgage.

Shop around. Always, always, always shop around for your mortgage. Same thing goes for homeowner’s insurance. Rates and premiums vary widely, so talking with multiple lenders and carriers will ensure you have the best price on both.